I'm going to be writing many financial-related posts mostly to record our family's progress to debt-free living. I hope along the way they will encourage others as well. My blog is also considerably new, so I'm not really sure how many readers I have!

A little background....

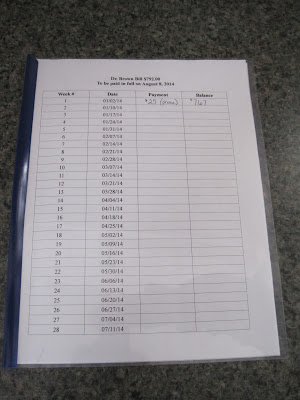

We are a single income family. I stay home full-time, homeschool our children. I also am manager of our finances (I'm continually learning and getting a little better). Not including our mortgage, we have a little over

$32,500 in debt. I'm taking baby steps in eliminating this debt, so I am not including our mortgage until I start eating away at these *little* things. I'm not ignoring the fact that our mortgage is a debt - it just helps me mentally to focus on the smaller debts for now. Our ultimate goal is to have our house completely paid off! Here is a look at our current list of debt:

1. Credit Card #1 $251

2. Credit Card #2 $608

3. Student Loan #1 $2,170

4. Student Loan #2 $3,057

5. Loan #1 $3,700

6. Loan #2 $4,591

7. Truck Loan $6,701

8. Car Loan $11,482

First thing is first.

We first need to bring all our current bills up to current.Thankfully, we aren't far behind. We are following many of Dave Ramsey's suggestions, so after we bring our bills to current we will put $1,000 into an Emergency Savings account. Afterward, we will start snowballing our way through these debts.

Budgeting

Would you believe that I'm actually excited to be implementing a budget? I don't feel panicked or restricted like some. I feel very, very optimistic to know that there is a light at the end of this debt-tunnel and that I

know where our money is going. Our current budget is as follows:

1. Food - $100 per week

2. Gas - $80 per week

3. Hubby's coffee - $10 per week

You're probably thinking why don't I just make my husband's coffee at home? Well, I do. My husband is also an electrical lineman and

he works outdoors all day, every day. Another hot cup of coffee in the middle of the day, especially during these frigid months, is almost a

must.

This week is our first week feeding our family of four (well, five, really - since we are pregnant with our third :) on $100. Surprisingly we are eating fairly healthy!Not perfect by any means, but not necessarily junk. Breakfast is typically our heartiest meal, lunch is light and dinner is also quite filling as it is one that is very important to us because we enjoy it together as a family. At this point in our finances I can't eat entirely organic - unless I spot a good deal - but I'm optimistic that one day, very soon, we will be able to do so.

Here is a look at this week's $100 menu:

Breakfasts:

*Hubby's breakfasts are always homemade breakfast sandwiches. I spend a weekend afternoon preparing and freezing these ahead of time. These consist of either a bagel or english muffin, sausage or bacon, egg and cheese.

For myself and the kids:

- Oatmeal, orange slices and milk

- Toast with butter or PB, scrambled eggs and orange slices

- Berry smoothie

Lunches:

*Hubby's lunches are either a tuna fish sandwich or BLT, leftovers, crackers, orange, and Powerade.

For myself and the kids:

- Mac and cheese, raw carrots and celery with dressing

- Grilled cheese, raw carrots and celery with dressing

- Leftovers

Dinners

- Shepherd's pie and vegetable

- Spaghetti, hamburg, sauce and garlic bread

- Stir fry with white rice

- Chicken, brown rice and vegetable

- Whole roast chicken, homemade stuffing, roast potatoes

- Italians, chips, juice boxes (we are eating dinner on the road this day)

- Pigs in a blanket and vegetable

Snacks

- Crackers with PB

- Fruit

The bright side of this $100 food budget is knowing that we are able to eliminate all this unwanted debt quickly. It also means that we will be able to open our budget down the road to organic options and more opportunity to eat out. Honestly, we rarely eat out to begin with, so we aren't at all feeling a loss here. We love our home-cooked meals.

Right now my focus is on what Dave Ramsey calls taking care of our Four Walls - House (mortgage/electric/heat), food, transportation and clothing. Next week's paycheck is going toward food/gas/coffee, filling our oil tank, car payment and half our electric bill. The following week's paycheck is going toward food/gas/coffee, our mortgage and cell phone bill.

I will give an update shortly on how we are doing on our way to debt-free living! Thanks for stopping by.