For those who have been waiting for an update on my most recent electric bill with our new Time-Of-Use service:

Our bill for the month of December is $87.70! That is $19.50 lower than our last bill! My goal was to get our bill under $100.

This is a big deal to us because #1 - it is winter. AND #2 our bill for

last December was $158.44! That is a difference of $70.74!

Some changes we've made with our electricity use along with our new Time-Of-Use service:

1. We turn off our hot water heater when it is not in use. We actually

started doing this half-way through the month, so I'm curious how much

lower our bill will be next month now that we are much more persistent

with it.

2. I started unplugging our washer and dryer when not

in use. I unplug just about everything else that isn't in use either,

except for the oven.

3. We work around our off-peak rate. We

take showers either early in the morning or after 8pm. We do our laundry

the same way or on the weekends. The dishwasher runs early in the

morning or after 8pm as well.

4. We switched to CFL lightbulbs.

5. Although we have used our oil furnace a few times in the morning

(sometimes we get lazy to stoke the fire in the middle of the night) our

woodstove has been our primary source of heat. I have also used our

woodstove to cook several times!

6. We rarely use our dryer. I hang dry our clothes, except for towels.

Thursday, January 16, 2014

Friday, January 3, 2014

Pantry Pancakes

Being on a strict $100/week grocery budget oftentimes calls for creativity to make the meals stretch. I think a lot of people automatically assume that when we put "budget" and "food" together it means we're sacrificing on taste, health and all those wonderful qualities we think we're missing. Not true. We aren't eating like pauper's over here, I can assure you that! We have three meals per day (snacks and dessert too!) that are both wholesome and delicious.

These pantry pancakes are perfect for keeping an easy breakfast or breakfast-for-dinner on hand. I like to make a big batch and freeze ours.

So, what exactly are Pantry Pancakes? Well, you throw together a bunch of ingredients that are in your pantry, fridge or freezer and add them to your favorite basic, pancake recipe. I really like this one.

Here's an example of ingredients I used in our last batch of Pantry Pancakes:

After rummaging through my cupboards and freezer I found frozen blueberries from the summer, oats, local rye flour, flaxseeds and wheat germ. I'm not the best at giving exact measurements when it comes to whim-recipes. I spend so much time in the kitchen I just eyeball it! If it's a little to thin, add more flour. If it's too thick, add some liquid. Speaking of, I also had some almond milk in the fridge for my batter.

I freeze our pancakes in between sheets of parchment paper. You'll definitely want to use something, even wax paper, to prevent your pancakes from sticking together.

It's fun and easy to get creative while on a budget. If you have a drop of creativity in your bones, you can stretch your food budget. If not, well, I'm here to help you, my friend! We're here to help each other navigate all the ways to our ultimate goal - a debt-free life! At some point, yes, you can open up your food budget. We will, for sure! For now, it's $100/week for our family, period.

Thursday, January 2, 2014

Facing Unexpected Medical Expenses (without freaking out!)

Yup, that was the total amount denied by my dental insurance and the total amount I now owe out-of-pocket. Since I am just beginning our baby steps to getting out of debt and saving money, I don't yet have an account for these unexpected medical expenses. Instead of freaking out, this is what I did:

1. I called my dentist office just to verify the balance and that it indeed was denied by our insurance. Yes, and yes.

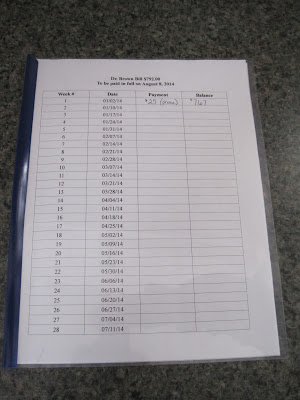

2. I asked if I could make a payment arrangement. I explained our situation and we quickly agreed on a doable amount. My next cleaning is in September, so I set a goal to have the balance paid off by then. We decided that I will pay $25 per week, and the balance will be paid off no later than August 8, 2014.

My organizational bug prompted me to create a template listing the week #, date, payment made and remaining balance. I used a report folder to hold both the bill and template

I've, of course, decided to add this to the list of debts I plan to snowball through. Yes, it is one more debt added to the list, but using the snowball method I should have this paid off much sooner than August! Therefore, I will not freak out.

Owe no man any thing, but to love one another:

for he that loveth another hath fulfilled the law.

Romans 13:8

Monday, December 30, 2013

Homemade Tea Tree Laundry Detergent

Making my own laundry detergent is another way I'm trying to stretch our budget! I've made a basic, homemade laundry detergent in powder-form in the past, but I am loving this liquid version (more like liquidy-gel) so much more! Plus, the antimicrobial qualities of tea-tree oil is a definite added bonus.

Here is the simple tutorial:

You'll need:

1 bar of Fels Naptha Soap, grated

1 Cup Arm & Hammer Super Washing Soda (not baking soda)

1/2 Cup Borax

20 drops tea tree oil (you could also do 1/2 tea tree and 1/2 lavender)

Heat 4 cups of water on stove with grated Fels Naptha. Stir and let it dissolve.

Fill large bucket 3/4 way full with water. Pour in the water with Fels Naptha.

Stir in washing soda and Borax.

Stir, stir, stir

Cover bucket with towel and let it sit for a few hours or overnight.

Transfer to containers or one large container. (I found the lovely 2-gallon glass container with lid from Walmart!)

Add tea tree oil and stir.

It always helps to have a little helper!

This is by far my favorite homemade laundry detergent so far. It makes our clothes smell wonderful and they come out very clean! We have a high-efficiency front load wash machine. I use a 1/2 Cup of detergent per load.

Friday, December 13, 2013

An extra $40.96 in one day for our Emergency Fund

If you look on the side bar to the right of my blog, you will see I've listed "Creatively Building Our $1,000 Emergency Fund". Here I am listing all of the creative ways in which we're making money for this fund. I update this as money is deposited into our emergency fund.

In one day we made an additional $40.96 to deposit into this account. It is possible to start building your emergency fund quickly - you just have to be willing to be creative and put in some time and effort!

Here is a breakdown of this week's deposits:

1. On Wednesday I sold $7 in items through our local Swap & Sell site. I do not arrange a meet up unless I'm already on my way to run errands. This saves on fuel.

2. While at the grocery store on Tuesday I used the Coin Star machine and received $13.37 in cash from our change jar. Make sure you have a change jar and keep putting your coins in it - even pennies you find on the ground. I'm telling you, these add up! Our change jar was empty last month and it wasn't even full when I cashed in this week. I got over $13 out of it!

3. Our bank has a rewards program through our checking account. We get cashback when we shop with certain companies that we'd normally shop at anyway. I received $6 this week.

4. I made $14.59 in Ebay sales on Thursday. I still have items with active bids, so this is just my initial profit!

All of this equals $40.96 in ONE day! I'm pretty excited, especially with the decluttering that is also taking place during this process.

Some tips:

1. Take time to list your items you'd like to sell, and make it look professional. Be honest, and thorough in your listings. Your customers will greatly appreciate it. Be courteous as well. I have many repeat customers both through Ebay and Swap & Sell.

2. Don't underestimate value of your "junk". There are items you own that someone else will love. Some items I really didn't think would sell were the first ones I'd hear an offer on!

3. Start rummaging your house and vehicles for change! You never know how much money is just laying around. Put them in a jar and cash in the next time you're out.

Our Ebay site: Mountaintop Bookseller

In one day we made an additional $40.96 to deposit into this account. It is possible to start building your emergency fund quickly - you just have to be willing to be creative and put in some time and effort!

Here is a breakdown of this week's deposits:

1. On Wednesday I sold $7 in items through our local Swap & Sell site. I do not arrange a meet up unless I'm already on my way to run errands. This saves on fuel.

2. While at the grocery store on Tuesday I used the Coin Star machine and received $13.37 in cash from our change jar. Make sure you have a change jar and keep putting your coins in it - even pennies you find on the ground. I'm telling you, these add up! Our change jar was empty last month and it wasn't even full when I cashed in this week. I got over $13 out of it!

3. Our bank has a rewards program through our checking account. We get cashback when we shop with certain companies that we'd normally shop at anyway. I received $6 this week.

4. I made $14.59 in Ebay sales on Thursday. I still have items with active bids, so this is just my initial profit!

All of this equals $40.96 in ONE day! I'm pretty excited, especially with the decluttering that is also taking place during this process.

Some tips:

1. Take time to list your items you'd like to sell, and make it look professional. Be honest, and thorough in your listings. Your customers will greatly appreciate it. Be courteous as well. I have many repeat customers both through Ebay and Swap & Sell.

2. Don't underestimate value of your "junk". There are items you own that someone else will love. Some items I really didn't think would sell were the first ones I'd hear an offer on!

3. Start rummaging your house and vehicles for change! You never know how much money is just laying around. Put them in a jar and cash in the next time you're out.

Our Ebay site: Mountaintop Bookseller

Monday, December 9, 2013

Building our $1000 Emergency Fund #1

As I have shared in my previous debt-free living posts, we are following Dave Ramsey's steps to getting out of debt. Since we are nearly caught up on our current bills, I'm finding ways to start building our $1000 Emergency Fund. I opened this account at a bank that is not attached to our checking. We are $895 away from our goal.

This week the steps I've taken to continue building our Emergency Fund:

1. I listed many items on Ebay. Most of these items are popular homeschool materials, so I'm confident they will sell.

2. I listed items in my Etsy Shop. I am also offering a 10% Off code to boost sales. My e-book Mama Don't Sew is my most popular and lowest priced item.

3. I plan to deposit the difference between October's electricity bill and this November's into the account. October's bill was $117.57. November's bill is $107.20. Therefore I'm going to deposit $10.37 into our Emergency Fund. I came up with this idea at the top of my head to continue with the momentum of saving money. Plus, creativity keeps me going!

4. Any profit from items I sell through our local Swap & Sell site I plan to deposit into our Emergency Fund.

5. Money from our change jar will be cashed and deposited on a monthly basis.

So those are the steps I'm currently taking to build our Emergency Fund! After this, we'll begin taking more chunks out of our debt.

This week the steps I've taken to continue building our Emergency Fund:

1. I listed many items on Ebay. Most of these items are popular homeschool materials, so I'm confident they will sell.

2. I listed items in my Etsy Shop. I am also offering a 10% Off code to boost sales. My e-book Mama Don't Sew is my most popular and lowest priced item.

3. I plan to deposit the difference between October's electricity bill and this November's into the account. October's bill was $117.57. November's bill is $107.20. Therefore I'm going to deposit $10.37 into our Emergency Fund. I came up with this idea at the top of my head to continue with the momentum of saving money. Plus, creativity keeps me going!

4. Any profit from items I sell through our local Swap & Sell site I plan to deposit into our Emergency Fund.

5. Money from our change jar will be cashed and deposited on a monthly basis.

So those are the steps I'm currently taking to build our Emergency Fund! After this, we'll begin taking more chunks out of our debt.

Sunday, December 8, 2013

Our November 2013 electric bill

I received our November electric bill and am happy to say that it is the lowest it has been all year! This is even before switching to the A-TOU rate I talked about in this post. I am so excited to see our next bill with this new rate, especially with this month's bill being much lower.

Last week I went through all of my electric bills from this past year and logged them in a notebook, so I could compare our usage for the year.

The set up in my notebook looks like this:

Month:

Amount due:

Daily Usage (kWh):

Monthly Usage:

Supply rate:

Delivery rate:

The highest it has been this year was February 2013 at $239.17! Our daily usage was 55 kWh. I am guessing we ran the furnace and dryer much more then. My husband just reminded me that we also had to run space heaters in the basement around that time when the water line froze right as it entered the house. My husband purchased a sheet of foam board insulation, dug and placed it against the foundation. We're hoping this does the trick.

Our bill for November 2013 is $107.20! Our daily usage was only 25 kWh. My goal is to get our next bill under $100, and if I can keep it that way throughout the winter it will make our plans to becoming debt-free that much quicker and easier. Every step counts.

Here are two things I've been doing that may have contributed to this lower electric bill:

1. I rarely use the dryer (only for towels). I hang dry all our clothes...on a rack, on the shower curtain rod, over doors and chairs, pretty much anywhere I can hang clothes.

2. We've been using our woodstove as our primary heat source. We did have oil delivered, but we're going to conserve this as much as we can. We have enough wood to heat our house all winter.

We are taking a few more steps this month to lowering our bill, in addition to our new rate and supplier. Our next step is to purchase an insulation blanket for our water heater. We also need to change out a couple remaining light bulbs to CFLs.

Last week I went through all of my electric bills from this past year and logged them in a notebook, so I could compare our usage for the year.

The set up in my notebook looks like this:

Month:

Amount due:

Daily Usage (kWh):

Monthly Usage:

Supply rate:

Delivery rate:

The highest it has been this year was February 2013 at $239.17! Our daily usage was 55 kWh. I am guessing we ran the furnace and dryer much more then. My husband just reminded me that we also had to run space heaters in the basement around that time when the water line froze right as it entered the house. My husband purchased a sheet of foam board insulation, dug and placed it against the foundation. We're hoping this does the trick.

Our bill for November 2013 is $107.20! Our daily usage was only 25 kWh. My goal is to get our next bill under $100, and if I can keep it that way throughout the winter it will make our plans to becoming debt-free that much quicker and easier. Every step counts.

Here are two things I've been doing that may have contributed to this lower electric bill:

1. I rarely use the dryer (only for towels). I hang dry all our clothes...on a rack, on the shower curtain rod, over doors and chairs, pretty much anywhere I can hang clothes.

2. We've been using our woodstove as our primary heat source. We did have oil delivered, but we're going to conserve this as much as we can. We have enough wood to heat our house all winter.

We are taking a few more steps this month to lowering our bill, in addition to our new rate and supplier. Our next step is to purchase an insulation blanket for our water heater. We also need to change out a couple remaining light bulbs to CFLs.

Subscribe to:

Comments (Atom)